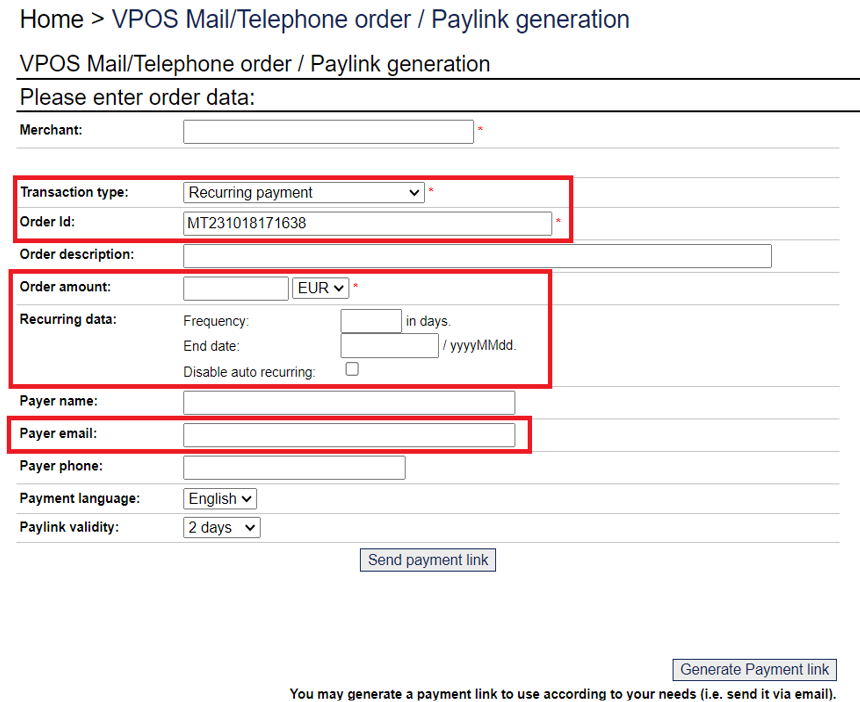

Payment gateway supports recurring transactions, allowing merchants of specific industries to perform future charges in their customer’s card, after having mutually agreed to do so.

Such cases could be a subscription to a service or a store or an agreement with a service provider for bill payments.

Recurring payments cannot co-exist with installments. Also, they are not compatible with digital wallets (Apple Pay/Google Pay), meaning that such wallets will not be available to complete a recurring transaction.

An established recurring scheme could either be executed at a specific frequency and with a specific amount (scheduled recurring – subsciptions) or at a frequency and/or with amount that will vary each time (unscheduled recurring – standing order).

In each case, the initial recurring transaction, must go through 3D authentication process.

The initial transaction cannot be refunded/voided in order for the subsequent transactions to be executed.

Token is not necessary for the execution of a subsequent (child) recurring transaction, so there is no need for tokenization (store card) during the initial (master) recurring transaction.