*To download the image, please right click on it and select ‘Save image as’.

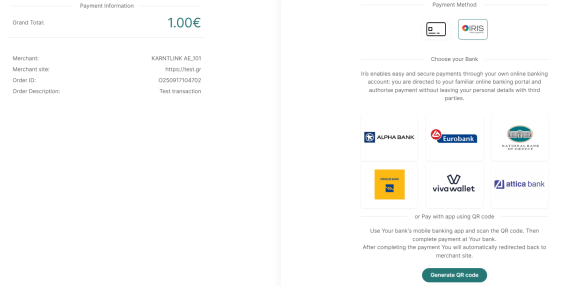

IRIS Payments is a real-time payment service that allows users to initiate payments through their bank’s mobile app through QR code or online banking, in a secure, user-friendly environment.

Online shops integrate IRIS Payments to allow customers to pay directly from their bank accounts, bypassing the need for credit or debit cards.