Introduction

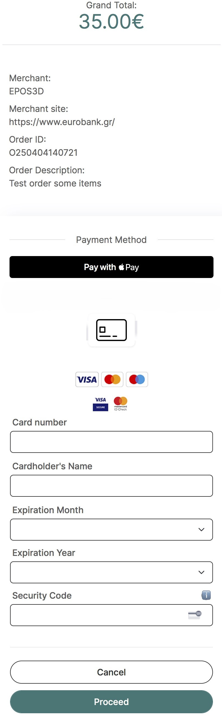

Apple Pay is a digital wallet service by Apple Inc. that enables secure and seamless payments across supported devices, like iPhone, iPad, and Mac. Apple Pay is integrated within the payment page to offer customers a fast and convenient payment experience.

User Experience

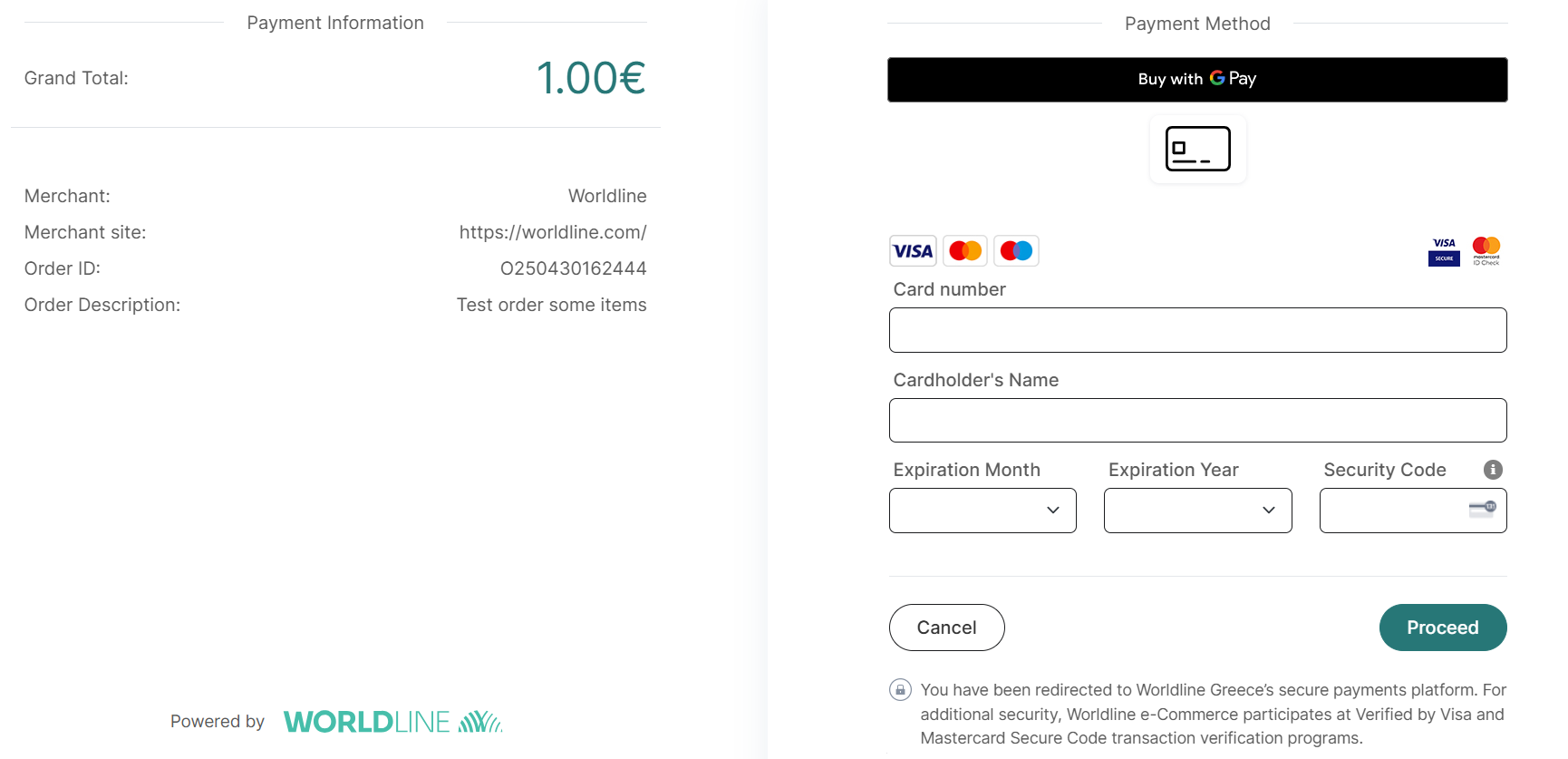

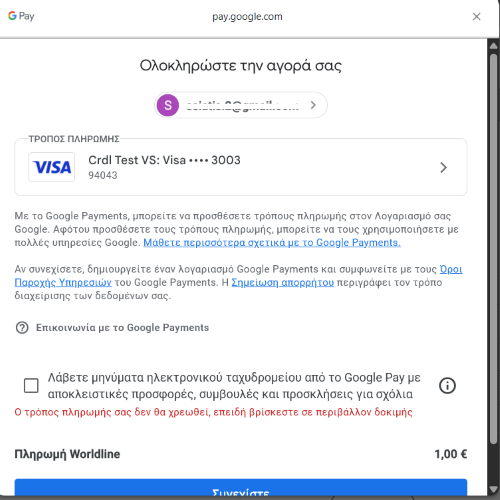

Apple Pay provides a seamless and intuitive payment experience for customers. When users check out:

- They select the Apple Pay option at the payment page.

- Their device prompts them to authenticate using Face ID, Touch ID, or a device passcode.

- The payment details are securely transmitted to the merchant.

- Upon successful transaction processing, the user receives confirmation instantly.

The entire process is designed for speed, security, and ease of use, reducing checkout friction and increasing conversion rates.

Requirements / Restrictions

– Transaction types supported: Payment, Pre-authorization, Refunds, Void.

– Schemes supported: Visa, Mastercard.

– Acquirers supported: Apple Pay transactions are being processed only through Worldline acquirer.

Important notice 1: Apple does not natively support iframe-based payment processing, so Apple Pay is not supported when an iframe is used to display the payment page.

Important notice 2: Tokenization is not supported through Apple Pay.

How to test

From the merchant’s/developer’s side: You need to activate Apple Pay in a newly created or already existing app in Sandbox, so as the respective Apple Pay button to appear in the payment page when the transaction is executed through a compatible device (iOS).

That test merchant number (MID) will also be automatically registered to Apple.

From the customer’s side: Use the below test account in your iOS device.

Test cards: If not already included in the Apple Pay wallet, you should add some of the below.

| Scheme/Type | PAN | Exp. Date | CVC |

| Mastercard | 5204245250460049 | 01/30 | 111 |

| 5204245250522095 | 01/30 | 111 | |

| 5204245251107599 | 01/30 | 111 | |

| 5204245253050839 | 01/30 | 111 | |

| 5204245254718095 | 01/30 | 111 | |

| Visa Credit | 4051069302200121 | 01/27 | 340 |

| 4761229700150465 | 01/27 | 175 | |

| 4761209980011439 | 01/27 | 466 | |

| Visa Debit | 4761120010000492 | 01/27 | 480 |

| 4761349750010326 | 01/27 | 982 | |

| 4761262260004228 | 01/27 | 501 | |

| 4761369980320253 | 01/27 | 878 | |

| 4622943120054839 | 01/27 | 100 | |

| 4180620070230189 | 01/27 | 111 | |

| 4123400073320224 | 01/27 | 221 |

You can now choose the desired test card to complete the transaction.